Image source: ET

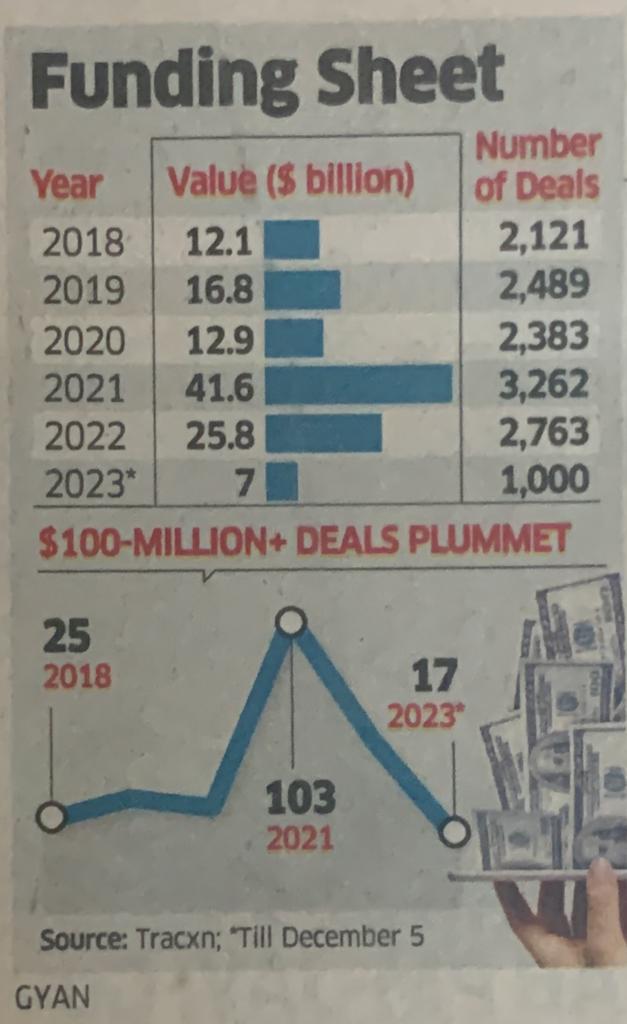

India’s startup funding landscape faced a significant downturn in 2023, experiencing a 73% drop, which propelled the nation from its once-held fourth place to fifth globally in terms of funding. This striking decline saw Indian tech startups securing a mere $7 billion in funding over the course of the year, marking the lowest level in the last five years, according to data sourced from the Geo Annual Report: India Tech 2023 by market intelligence platform Tracxn.

Bengaluru, Mumbai, and Delhi-NCR retained their positions as the most heavily funded cities within India’s startup ecosystem. However, these cities couldn’t shield the nation from the overall funding decline. In Q4 2023, India recorded its lowest quarterly funding total since the third quarter of 2016, with only $957 million in investments.

This funding drought can be primarily attributed to the dramatic plunge in late-stage funding, which plummeted by over 73% to a mere $4.2 billion in 2023 compared to the previous year’s $15.6 billion. The number of funding rounds exceeding $100 million also saw a substantial 69% drop compared to the previous year.

Within the fintech sector, funding dipped from $5.8 billion to $2.1 billion, with PhonePe securing a significant chunk of $750 million, accounting for 38% of the total funding within the sector. Notable companies such as Perfios, Insurancedekho, and Kreditbee also garnered substantial funding in this sector.

Despite the overall funding gloom, some venture firms continued to remain active. LetsVenture, Accel, and Blume Ventures emerged as the most active investors throughout 2023. However, the year only saw the creation of two new unicorns, Incred and Zepto, a significant drop from the 23 created in the previous year.

2023 proved to be a challenging year for India’s startup ecosystem, with a substantial decrease in funding across the board, particularly in the late-stage funding segment. While some bright spots remained, the overall trend signaled a need for innovative approaches and strategies to revitalize the funding landscape in the years ahead.