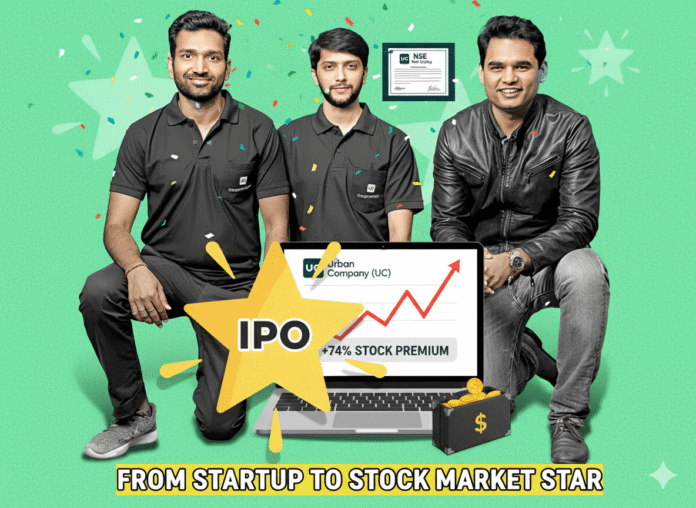

Urban Company made a strong debut on Indian stock exchanges on Wednesday, with its shares listing at a 58% premium over the issue price of ₹103. The stock opened at ₹162.25 apiece on the NSE, up 57.52%, and at ₹161 on the BSE, up 56.3%. Within the first few minutes of trading, the stock climbed further to ₹179 on NSE—about 74% higher than its IPO price. This pushed the company’s market capitalization to nearly ₹24,771 crore as of 10:07 a.m., marking one of the most successful startup listings in recent years.

On the eve of the listing, CEO Abhiraj Singh Bhal emphasized that the massive 100x subscription of the IPO was not a victory lap, but a responsibility. “We are fully cognisant that this is not a reflection of where the company is today—it is a promise of what the company could be in the future. For us, it’s more about the weight of responsibility,” he said. He added that while the timing of the IPO coincided with aggressive investments in InstaHelp, there is never a “perfect time” to go public, as ambitious companies must continue to place bold bets in dynamic markets.

The IPO proceeds of ₹472 crore will be used strategically to fuel growth: around ₹190 crore will be invested in new technology development and cloud infrastructure, ₹70 crore in office leases, ₹80 crore in marketing activities, with the rest allocated for general corporate purposes.

Financially, Urban Company turned profitable in FY25. It reported a 38% increase in operating revenue to ₹1,144 crore and swung into the black with a net profit of ₹240 crore, aided by a deferred tax credit of ₹211 crore. Even on a pre-tax basis, the company recorded a profit of ₹28 crore, a significant turnaround from its ₹93 crore net loss in FY24 and ₹312 crore loss in FY23. The steady improvement in revenue—from ₹827 crore in FY24 to ₹1,144 crore in FY25—underscores the company’s growing scale and operational discipline.

The Founders’ Journey

Urban Company, founded in 2014, is the brainchild of Abhiraj Singh Bhal (Managing Director & CEO), Raghav Chandra (Executive Director & CTPO), and Varun Khaitan (Executive Director & COO). The trio, all engineering graduates from India’s top institutions, shared a vision of creating a platform that could revolutionize local services in India. Starting as UrbanClap, the company initially struggled to balance customer demand and service provider quality. Over time, it evolved into a full-stack model, where it directly trains and manages service professionals in beauty, wellness, home repair, and cleaning services.

Abhiraj Singh Bhal, an IIT Kanpur alumnus and former BCG consultant, has been the driving force behind the company’s strategic vision and expansion. Known for his long-term thinking and customer-centric approach, he has positioned Urban Company as India’s leading home services platform.

Raghav Chandra, an IIT Kharagpur graduate and former Twitter engineer, leads the company’s technology and product innovation. As CTPO, he has been instrumental in building Urban Company’s app ecosystem, AI-driven matching algorithms, and cloud-based systems that ensure scalability.

Varun Khaitan, also from IIT Kanpur, plays a crucial role in operations. As COO, he focuses on training, workforce management, and ensuring service quality across thousands of professionals. His execution-driven approach has helped scale the business to multiple cities across India and international markets like the UAE and Singapore.

From a small startup in Gurgaon to a household name across urban India, Urban Company’s journey reflects the resilience and ambition of its founders. Their leadership has turned a simple idea—connecting customers with trusted service providers—into a global platform now backed by marquee investors such as Tiger Global, Accel, and Vy Capital.

Today, Urban Company stands not only as a profitable startup but also as a symbol of India’s maturing tech ecosystem. Its listing success reinforces the confidence investors have in new-age Indian companies that combine technology, service quality, and consumer trust.