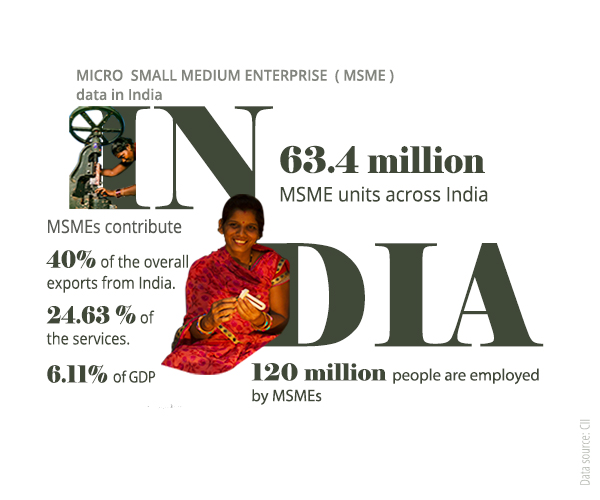

Platform Businesses can provide the “Escape Velocity” for Micro Small and Medium Enterprises (MSME) to move to the next level of productivity and value capture. They can help MSME overcome four major challenges related to Finance- access and payments; Supply Chain- Inbound and Outbound; Marketing- Branding and Distribution; and even Human Resource Management- Recruitment and Training.

Finance- Access and Payments are a major pain point for MSMEs as they are not fully integrated into the formal financial ecosystem. FinTech platforms like Crediwatch (an information intelligence platform) and ML-based digital lender Happy Loans provide data insights to lenders to offer loan products to MSME which may not have passed the regular financial viability measurements. Similarly, Paymentech platforms like Mswipe and RazorpayX provide payment acceptance and POS enablement thus revolutionising the digital payment space for merchants across the country

Supply Chain- Inbound and Outbound are very important for MSME where margins are thin and any inventory carrying cost or even stock out can cause a major burden on cash flows. Automobile spare parts e-commerce players like AutoZilla can help the garages or even fleet owners to ensure spare part availability across major cities of the country. This is great value for them as they get access to genuine spare parts with minimum price variations across the entire country. Similarly, platforms like Locushave a free tool ‘QuickStart,’ for start-ups and small and medium enterprises to improve their supply chain efficiency.

Marketing- Branding and Distribution related platforms can create tremendous opportunities for the MSMEs as they lack the financial muscle to create sustained customer

interest in both B2C and B2B sectors. Platforms like Meesho have enabled small businesses and even individuals to start their online stores via social channels such as WhatsApp, Facebook, Instagram, etc thereby lowering the barriers to gaining distribution. Tradeindia and IndiaMart foster an online B2B marketplace, connecting buyers and suppliers thus helping SMEs go digital. OTT platform developed by MyStartUpTV can also help the start-ups and those supported by these neighbourhood commerce ecosystems would benefit from faster and more efficient brand building

Human Resource Management- Recruitment and Training can become a major barrier to MSME’s growth and scale-up ambitions. This is even more important because the MSME segment is seen as a major job creator and also the fact that the quality and conditions of the jobs created are often doubtful. Multiple digital platforms are helping MSMEs solve their problems related to low-quality human capital.

We can also consider neighbourhood commerce, especially the street vendors as Nano-Businesses. The street vendor and platform business relationship could be understood through a Three-Legged Stool- Discovery, Payment and Logistics- and platforms have played an important role in its growth over the last few years, especially during demonetisation and covid19 pandemic.

Platforms have been pathbreaking in helping us in the discovery process for singers/chefs/writers etc and all of us have an interesting story about finding our inspiration without even looking for it. For example, at Trice Community, residents in gated communities are glad to reach their favourite home chefs/artists/cause directly and vice versa.

Micropayments have been revolutionised by platforms mostly with the support of the Unified Payment Interface (UPI) launched by the National Payment Corporation of India (NPCI). Launched in 2016, UPI has seen tremendous adoption during the immediate use case following the demonetisation, further accelerated by the Covid-19 outbreak. According to the latest report, in the calendar year 2021, UPI had processed more than 38 billion transactions, amounting to Rs 71.59 trillion. In 2021-22 (Financial Year 22) so far, it has processed more than 31 billion transactions, surpassing the transactions processed in 2020-21 (FY21).

Amongst others, Jio with its PoS machine installed in Kirana stores, has better visibility of stock and flow in the stores and thus would be in a better position to provide credit facilities as well.

From another perspective, we can look at HyperLocal businesses and the delivery ecosystem to appreciate how in the era of hyper-globalisation, we crave local connections. Location-based platforms can help in finding the connections from your proximity.

Crowdsourcing of Assets unlocks extraordinary value for both suppliers and buyers. Retail Operations especially for the local street vendors have been extraordinarily helped by last-mile delivery partners like Dunzo and Shadowfax. Some of them also provide warehousing, payment collection and reverse logistics.

To conclude, more users are interested in local/niche products & services and the neighbourhood commerce ecosystem should step up to serve this efficiently. Platforms like TRICE which provide discovery, payments and last-mile logistics can play a pivotal role in bringing business and dignity to millions of street vendors across the communities.

So, next time you want to buy something, spare a thought for the local vendor and give your business to your friendly neighbourhood!

Put a Smile on their Face!

Image credit: https://hihindia.org