Finance and technology, two major contributors to development, have joined forces as an innovation known as Fintech. It has enabled consumers to open bank accounts, take out loans, transfer money, or buy life insurance on their smartphones, bypassing the hefty fees and regulatory restrictions imposed by traditional banks, bringing financial access to their fingertips. All of this happened in India in a matter of years, which took everyone by surprise. When the country only had 737 fintech startups, it now has 2,565. By June 2022, 23 Indian FinTech start-ups had achieved “Unicorn Status” and were valued at more than $1 billion. Because no achievement is free, the Indian government and venture capitalists have played an important role.

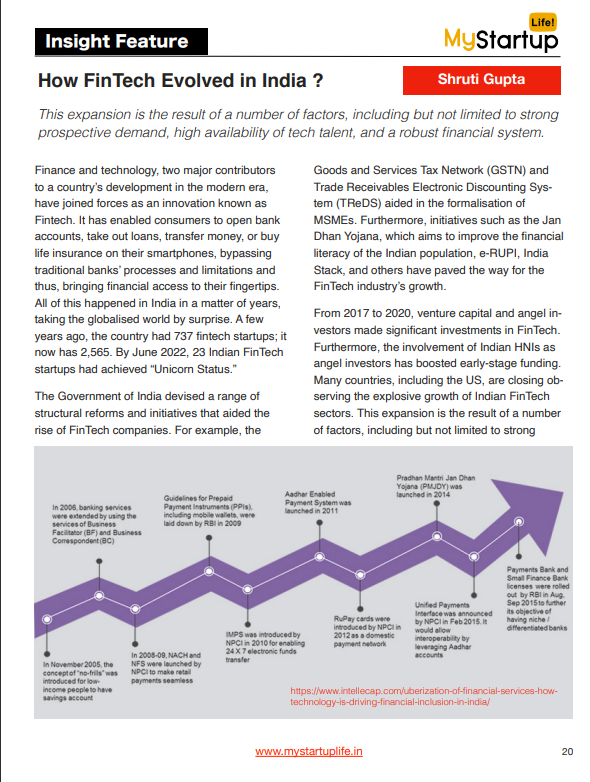

The Government of India devised a range of structural reforms and initiatives that aided the rise of FinTech companies. The Goods and Services Tax Network (GSTN) and Trade Receivables Electronic Discounting System (TReDS), for example, aided in the formalization of MSMEs. Furthermore, initiatives such as the Jan Dhan Yojana, which aims to improve the financial literacy of the Indian population, e-RUPI, India Stack, and others have paved the way for the growth of the FinTech industry.

From 2017 to 2020, venture capital and angel investors made significant investments in FinTech. Furthermore, the involvement of Indian HNIs as angel investors has boosted early-stage funding. Many platforms describe the explosive growth of Indian FinTech start-ups. This expansion is the result of a number of factors, including strong prospective demand, a high availability of tech talent, and a strong investment system. The significant value of the country’s financial services, as well as the willingness to quickly shift to the digital medium, have significantly contributed to FinTech’s rise. Furthermore, the growing number of smartphone users (550-600 million phones in 2020, up 60% from 2016) who use the internet has increased demand for FinTech services. Exploration of the untapped potential of FinTech services has also contributed to the explosive growth.

Innovative digital infrastructure in India, such as Aadhaar and UPI, have allowed for the smooth integration and diversification of fintech services to reach a large population.

According to estimates, India produces nearly 2.7 million STEM graduates per year, which is more than the number of STEM graduates in the United States, United Kingdom, and Germany. Attracted by the large talent pool, multinational corporations such as Google have established advanced capabilities centres in the country that serve as a recruitment hub for FinTech firms.

The large number of workers involved in technology has allowed FinTech companies to take advantage of competition and hire employees at lower wages than in other countries.

Fintech has intrigued venture capitalists to Indian startups. The primary reason for investor confidence has always been technology’s fast-growing demand and addressable market.

The rate of growth of startups is increasing year after year, creating a massive money market for fintech companies. The question arises that what and how fintech companies work, well the FinTech market consists of sales of technology and platform based financial services and related goods. Through the use of technology and innovation, they provide financial services through internet-based platforms. On the back end, it is used by end-user organisations to automate insurance, trading, banking services, and risk management.

According to data, fintech startups in India recorded the highest deal in 2021 in the subsectors of lending technology and digital payment. The Indian fintech market is expected to be worth $1.3 trillion by 2025, growing at a CAGR of 31% between 2021 and 2025.Insurance technology is growing faster than any other fintech subsegment. Third-world countries such as India, Bangladesh, Bhutan, Africa, and others are shifting to an E-payments structure. The government of India has created various apps such as BHIM, e-RUPI, and other digital payments at banks, which will soon become a huge mark for FinTech companies in these countries. The pandemic has created more opportunities to go digital with finances.

After the covid-19, credits to digital-savvy customers, the buy-now-pay-later (BNPL) model under lending tech took a quantum leap. According to estimates, the BNPL space could provide a $43 billion market opportunity by 2025, with an 80 percent CAGR growth rate. ePayLater, Simpl, and ZestMoney are standalone startups with BNPL services, as are ecommerce companies and fintech players with introduced products. Paytm, Postpaid, LazyPay, Amazon Pay, and Flipkart Pay Later are a few well-known and widely used companies. It also makes digital payments and physical cards possible.

There are several types of FinTech companies that are gaining traction: Neobanking, which includes digital banks such as BharatPe in India; Investment Tech, which is attracting security investments in order to increase total equity in the Indian stock market; Because of its non-life insurances, insurtech is the fastest-growing fintech subsector in terms of market size; Fintech SaaS solutions such as app-based accounting & bookkeeping, no-code payment aggregation have accelerated adoption of digital financial products and services among India’s SMBs; Every year, market consolidation focuses on IPOs such as MobiKwik and Pine Labs.

India’s Fintech Market is an Emerging Trend. India’s growing adoption of financial technology products and services is not new. More than 67 percent of fintech companies were founded in the last five years, indicating that digitalisation has only recently begun. In India, there are over 2100 Fintech companies. In the last year, India’s Fintech sector has seen exponential growth in funding, with investments totaling more than US$8 billion received at various stages of development. There are several models and players in place for this thriving market that is leading to a realm of digital commerce and age.